For the past few years, the housing market has been unbalanced. Strong demand and lean supply keep pushing prices higher and higher.

For the past few years, the housing market has been unbalanced. Strong demand and lean supply keep pushing prices higher and higher.

On Wednesday, a fresh piece of data confirmed that trend. The Mortgage Bankers Association’s weekly purchase loan data showed that the average size of a home loan was the largest in the history of its survey, which goes back to 1990.

Higher prices have a few different effects on the market. Buyers have to make tradeoffs on the kinds of homes they can afford, or may be shut out of ownership altogether.

They may also adjust their borrowing. Larger mortgage sizes may reflect not just more expensive properties, but also more leveraged ones.

The 20% down payment is a relic: the median down payment in 2016 was 10%. For first-time buyers, it was 6%. First-timers and other buyers of less-expensive homes are more leveraged now than they were at the height of the housing bubble a decade ago.

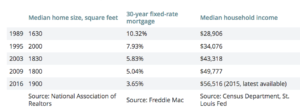

Home loan sizes aren’t the only things that have changed in the years since MBA started its survey. Back at the start of the survey, the median mortgage size was only about 3.3 times the median annual income. It’s now over five times as big – though buyers get bigger homes and lower interest rates.

Here’s a look at some housing market characteristics for select years.

Recent Comments