by LLT | Mar 9, 2017 | LLT, News

As interest rates surged last week and home prices continue to balloon at a breakneck pace, borrowers are wasting no time applying for home loans — they are hoping to get in before affordability gets even worse.

As interest rates surged last week and home prices continue to balloon at a breakneck pace, borrowers are wasting no time applying for home loans — they are hoping to get in before affordability gets even worse.

Homebuyers are also increasingly choosing adjustable-rate mortgages, hoping to save a few more dollars on monthly payments.

Total mortgage application volume rose a seasonally adjusted 3.3 percent last week from the previous week, according to the Mortgage Bankers Association. Volume remains 18 percent lower compared to the same week one year ago.

The weaker volume primarily stems from significantly fewer applications to refinance from a year ago, when interest rates were lower. Refinance volume is off 34 percent annually, but more borrowers rushed in last week, likely fearing rates would move even higher. Refinance volume was up 5 percent for the week, seasonally adjusted.

“Mortgage rates increased last week as remarks by several key Federal Reserve officials strongly signaled a March rate increase,” said Joel Kan, an MBA economist. “This was further supported by a few solid economic data releases, including GDP, inflation and manufacturing gauges.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of $424,100 or less increased to 4.36 percent from 4.30 percent, with points increasing to 0.44 from 0.38, including the origination fee, for 80 percent loan-to-value ratio loans.

Although mortgage rates do not directly follow the federal funds rate, a Fed rate hike could still make mortgages more expensive. After rising last week, mortgage rates have barely moved this week, which could be a sign of apprehension.

“Combine the past few days of limited movement with the bigger-picture post-election range, and there’s a sense that we’re waiting for a verdict about where we go next,” wrote Matthew Graham, chief operating officer of Mortgage News Daily. “[That] makes the next six business days scary. It’s ultimately next Wednesday that has the biggest potential to push rates higher or lower, but there’s plenty of room for volatility between now and then.”

Next Wednesday is when the Fed announces its decision on interest rates, and an increase is expected.

Mortgage applications to purchase a home, which are less sensitive to weekly rate moves, inched 2 percent higher for the week and are about 4 percent higher than a year ago. Homebuyer demand remains quite high, but there is still a shortage of affordable listings. Because much of the demand this spring is among young first-time buyers, the shortage is even more acute.

Continue reading.

by LLT | Mar 8, 2017 | LLT, News

Both buyers and sellers alike are feeling very good about the housing market this spring, even as home values hit new highs and mortgage rates move up.

Both buyers and sellers alike are feeling very good about the housing market this spring, even as home values hit new highs and mortgage rates move up.

A monthly sentiment index from Fannie Mae rose to the highest level since 2011, when the survey began, thanks to a surprising surge from millennials.

“Millennials showed especially strong increases in job confidence and income gains, a necessary precursor for increased housing demand from first-time homebuyers,” said Doug Duncan, senior vice president and chief economist at Fannie Mae.

Millennials are moving out of their parents’ basements and forming new households at a faster rate, according to Fannie Mae research, but they are still overwhelmingly forced to rent.

“Continued slow supply growth implies continued strong price appreciation and affordability constraints facing millennials and first-time buyers in many markets,” Duncan added.

The leading edge of the millennial generation is, however, entering the housing market in larger numbers today, with some venturing out of their desired urban cores to more affordable suburbs. Millennials delayed both marriage and parenthood, but that is now changing.

Nearly half of millennial buyers had at least one child, according to the 2017 Home Buyer and Seller Generational report just released by the National Association of Realtors. That is up from 45 percent last year and 43 percent two years ago. Children are the primary driver of homeownership, which is now sitting near a record low. Just 15 percent of millennial buyers chose an urban area, which is down from 17 percent last year and 21 percent two years ago.

“Millennial buyers, at 85 percent, were the most likely generation to view their home purchase as a good financial investment,” said Lawrence Yun, chief economist at the Realtors. “These strong feelings bode well for even greater demand in the future as more millennials settle down and begin raising families.”

Those numbers would likely be far stronger if home values were not being forced higher by tight supplies of homes for sale, especially starter homes. Nationally, home values rose 6.9 percent in January year over year, according to CoreLogic. That is far faster than income growth but slightly lower than the annual price appreciation in December — perhaps a sign that the jump in mortgage rates after the presidential election is cutting into prices, even slightly.

Continue reading.

by LLT | Mar 7, 2017 | LLT, News

Housing data in January gave mixed signals on the direction for the year. Closing activity for existing home sales shot up to a decade-high of 5.69 million units at an annualized pace, but pending contracts fell to their lowest level in 12 months. For the whole of 2017, I expect existing home sales to reach 5.6 million, which would be a gain of 2.2% from the prior year, but below the annualized pace set in January. In short, expect sideway movements for the rest of the year.

Housing data in January gave mixed signals on the direction for the year. Closing activity for existing home sales shot up to a decade-high of 5.69 million units at an annualized pace, but pending contracts fell to their lowest level in 12 months. For the whole of 2017, I expect existing home sales to reach 5.6 million, which would be a gain of 2.2% from the prior year, but below the annualized pace set in January. In short, expect sideway movements for the rest of the year.

Even though home sales will not make much gains, home prices will. With inventories still at grossly inadequate levels, there is only one direction to go for home prices. The national median price will likely rise by 4% to 5%. Do not be surprised if it goes up even higher. While the country needs around 1.6 million new housing starts, only around 1.3 million units will be constructed, based on permit information and from labor and lot shortages facing the industry.

For local markets, check how new home construction is coming online in relation to local job growth to gauge if home prices will outpace the national average growth rate. For example, in Savannah, Georgia, there have been only 6,000 new units built cumulatively over the past three years while 18,000 net new jobs have been added. Historically, one new housing unit is required for every two new jobs. Therefore, demand is outpacing supply there and home price outlook is solid in Savannah.

Though there are many short-term factors and dynamics at play, it is also worthwhile to gauge what is likely to happen over the long-term. Specifically, housing demand over the next decade will be notably higher than it is now. The combined factors of a rising population and jobs with the release of the pent-up demand will be the principal drivers.

Continue reading.

by LLT | Mar 6, 2017 | LLT, News

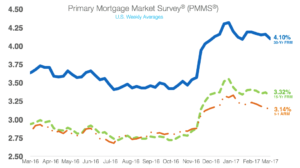

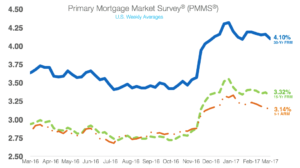

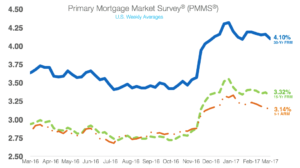

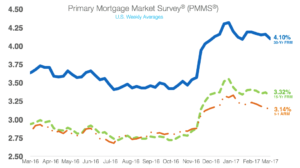

30-year mortgage rate holds relatively steady in 2017

30-year mortgage rate holds relatively steady in 2017

Mortgage rates broke their month-long holding pattern as they decreased this week, according to Freddie Mac’s Primary Mortgage Market Survey.

“Since the beginning of the year, the 10-year Treasury yield has covered a 22 basis-point range,” Freddie Mac Chief Economist Sean Becketti said. “The range of movement for the 30-year has been half that, just 11 basis points.”

The 30-year fixed rate mortgage decreased to 4.1% for the week ending March 2, 2017. This is down from last week’s 4.16% but still up from last year’s 3.64%.

The 15-year FRM also dropped to 3.32%, down from last week’s 3.37% but still up from last year’s 2.94%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage decreased slightly to 3.14%, down from 3.16% last week. This is up from 2.84% last year.

“The 10-year Treasury yield remained relatively flat this week, while the 30-year mortgage rate fell six basis points to 4.1%,” Becketti said.

Read the full article.

by LLT | Mar 3, 2017 | LLT, News

Deed restrictions can bring nasty surprises to homeowners looking to remodel or even when buying a home. These restrictions can limit a number of property features, such as the number of bedrooms in your home, the building height, the type of vehicles in your driveway, the fencing permitted, the type and number of trees that can be removed from a property, and even the style and color of construction materials used in a renovation (which often is intended to limit architectural variations in a neighborhood).

Deed restrictions can bring nasty surprises to homeowners looking to remodel or even when buying a home. These restrictions can limit a number of property features, such as the number of bedrooms in your home, the building height, the type of vehicles in your driveway, the fencing permitted, the type and number of trees that can be removed from a property, and even the style and color of construction materials used in a renovation (which often is intended to limit architectural variations in a neighborhood).

Be sure to make your clients aware of any deed restrictions—often called “restrictive covenants”—before they buy to avoid problems later on. The property does not have to be part of a homeowners association to be limited by a developer rule included in a deed.

“Deed restrictions turn up during title searches and a careful reading of the current deed,” a realtor.com® article notes. Anyone who buys the property must abide by the restrictions, even if they were put in place on the land a century ago. Deed restrictions are known for being difficult to change and often take a judicial ruling to invalidate them.

“When building a new home, or even doing an addition to your current home, it’s vital that you check your deed for any building restrictions,” says Bill Golden, a real estate professional in Atlanta.

Zachary D. Schorr, a Los Angeles real estate attorney, told realtor.com® that he’s seen deed restrictions run the gamut, such as those that required exterior paint colors to match colors found in nature to those that restricted rental properties.

“With the rise of VRBO and Airbnb, we are even seeing restrictions on nightly rentals and the minimum rental period for a house,” Schorr says.

Read the full article.

by LLT | Mar 2, 2017 | LLT, News

Treasury Secretary Steven Mnuchin speaks at a press briefing at the White House in Washington, U.S., February 14, 2017. REUTERS/Kevin Lamarque

U.S. Treasury Secretary Steven Mnuchin said on Wednesday the Trump administration’s tax reform plan will not change the deductibility of mortgage interest and charitable contributions.

“Let me first clarify, we are not taking away the charitable deduction and we are leaving the mortgage interest deduction as is,” Mnuchin said in an interview on Fox Business Network.

“We think those are both very, very important. But what we are going to do is we are looking at other things where the reduction in deductions will offset the rate,” he said.

On Dec. 1, prior to President Donald Trump taking office, Mnuchin told CNBC that Trump wanted to cap the amount of mortgage interest that taxpayers can deduct.

The mortgage interest deduction is already capped at loans up to $1 million if you are married and filing income taxes jointly, and at $500,000 if you file separately.

Trump, in a speech to Congress on Tuesday night, said he wanted to provide “massive tax relief” to the middle class and cut corporate tax rates, but he did not offer specifics.

Mnuchin said he expects a tax reform plan to be passed by Congress and signed by the president by August.

Trump has said tax reform should reduce tax rates for individuals and businesses, do away with longstanding tax loopholes and broaden the tax base in order to drive U.S. economic growth.

Read the full article.

As interest rates surged last week and home prices continue to balloon at a breakneck pace, borrowers are wasting no time applying for home loans — they are hoping to get in before affordability gets even worse.

As interest rates surged last week and home prices continue to balloon at a breakneck pace, borrowers are wasting no time applying for home loans — they are hoping to get in before affordability gets even worse.

Recent Comments