by LLT | Feb 10, 2017 | LLT, News

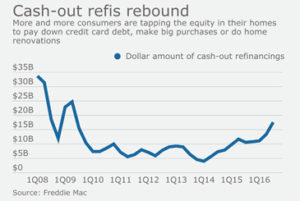

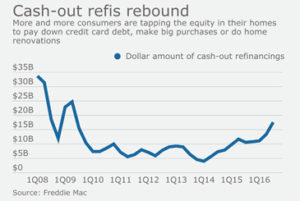

The surge in home values is good news for homeowners looking to tap the equity in their homes to pay down debt or make big purchases, but consumer advocates worry that it may be setting the stage for a spike in loan defaults.

The surge in home values is good news for homeowners looking to tap the equity in their homes to pay down debt or make big purchases, but consumer advocates worry that it may be setting the stage for a spike in loan defaults.

Consumers have plenty of reasons to tap into their home equity, such as paying off credit card debt or financing long-delayed home-improvement projects. Banks are happy to oblige, especially with rising interest rates suppressing demand for traditional mortgage refinancing.

The problem is that a cash-out refi is much riskier than a credit card loan, said Sarah Wolff, a senior researcher at the Center for Responsible Lending.

“You are trading your unsecured debt for debt that’s tied to your home, and a default in that case would be much more catastrophic,” she said.

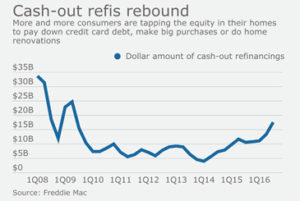

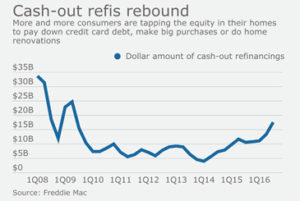

Banks are already seeing increased demand for cash-out refis. The total dollar amount of home equity cashed out rose 66% to $17.6 billion in the third quarter compared to the same period in 2015, according to Freddie Mac. The trend shows little sign of slowing down, said Len Kiefer, deputy chief economist at Freddie Mac.

“We expect overall volume of cash-out refis to trend higher,” Kiefer said.

Other lenders have placed bets recently that variations on the cash-out refinance model could catch fire with consumers. SoFi and Fannie Mae in November introduced a cash-out refi option specifically for paying down student loan debt.

Still, the overall industry level of cash-out refi volume remains at extremely low levels, even after a recent period of recovery, Kiefer said. The total dollar value of cash-out refis remained below $10 billion for several years during the recession. They have slowly inched back up, but remain well below pre-crisis levels of $30 billion and higher, so banks have plenty of capacity to lend, Kiefer said.

Interest rate shifts could also lead to more cash-out refis. The prime rate, which climbed to 3.75% in the fourth quarter, could continue to rise if the Federal Reserve proceeds with rate hikes. Credit card debt, largely based on the prime rate, could become more expensive and consumers could use cash-out refis to pay off those cards, Kiefer said.

That’s where the problems could surface for consumers, said the Center for Responsible Lending’s Wolff.

Total household debt rose 2.4% to $12.35 trillion in the third quarter compared to the same period in the previous year, according to the Center for Microeconomic Data at the Federal Reserve Bank of New York. Credit card debt, a portion of that total, rose 4.6% to $747 billion in the same period.

Continue reading.

by LLT | Feb 9, 2017 | LLT, News

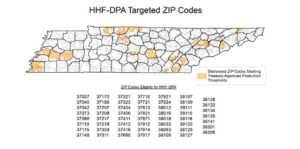

The Tennessee Housing Development Agency is offering $15,000 in down payment assistance to help people who want to purchase a house in certain zip codes.

The Tennessee Housing Development Agency is offering $15,000 in down payment assistance to help people who want to purchase a house in certain zip codes.

Couple Ryne Iseminger and Paige Martin recently got engaged and are now talking about purchasing their first home.

“That is definitely something we are discussing. Pretty much daily,” said Iseminger.

After renting a home for nine years, the couple just learned about a new incentive making buying a house in Middle Tennessee an exciting option.

The Tennessee Housing Development Agency received $60 million in federal money from the U.S. Treasury’s Hardest Hit Fund.

Eligible borrowers will have access to that money.

“We will give you $15,000 in down payment and closing costs. It is forgivable over 10 years, no interest during that time, no payments during that time,” explained THDA’s Executive Director Ralph Perrey.

THDA will forgive 20 percent of the loan each year after six years until it is gone if you stay in the house. If the borrower does not refinance, sell, or move out of the home for 10 years, the entire $15,000 loan is forgiven.

“The idea here is to improve those neighborhoods, to strengthen neighborhoods not merely with investment but by the presence of invested home owners,” said Perrey.

Martin told News 2 she is tired of renting.

“You feel like every month when you write a check, it is pretty much going out the door and you will never see it again,” said Martin.

The goal is to revitalize communities in middle Tennessee that never recovered from the economic downturn.

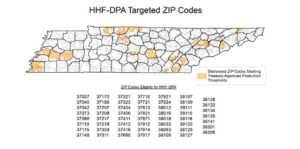

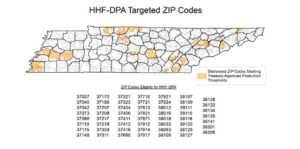

THDA’s $15,000 down payment assistance program is available in 55 targeted zip codes spanning parts of 30 counties across Tennessee.

“That would just be a huge relief and definitely accelerate our plans to be able to move into a neighborhood faster then what we thought,” said resident Nikki Tigg who has been house hunting with her husband.

Read the full article here.

by LLT | Feb 8, 2017 | LLT, News

Mortgage rates have been wavering in a tight range for the past month, but a slight decrease last week helped put some energy back into the mortgage market.

Mortgage rates have been wavering in a tight range for the past month, but a slight decrease last week helped put some energy back into the mortgage market.

Total mortgage application volume rose 2.3 percent on a seasonally adjusted basis for the week from the previous week, according to the Mortgage Bankers Association. Applications, however, are still running a stark 23 percent below year-ago levels, due to a massive drop in loan refinancing.

Mortgage applications to refinance home loans increased 2 percent for the week, seasonally adjusted, but are 40 percent lower than a year ago. That’s because rates are higher than one year ago, and so many borrowers have already refinanced to near record-low rates that the pool of potential refinancers is shrinking.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,000 or less) decreased to 4.35 percent from 4.39 percent, with points remaining unchanged at 0.34 (including the origination fee) for 80 percent loan-to-value-ratio loans. The average rate in the same week last year was a full 44 basis points lower, at 3.91 percent.

by LLT | Feb 7, 2017 | LLT, News

The foreclosure picture continues to improve in the U.S., according to the recently released Black Knight Financial Services Mortgage Monitor.

The foreclosure picture continues to improve in the U.S., according to the recently released Black Knight Financial Services Mortgage Monitor.

An increase in cure activity, defined as a borrower paying their mortgage current from some stage of delinquency or foreclosure, helped in part to improve delinquencies in December 2016 according to the report. It also said more than 450,000 borrowers paid themselves current on their mortgages, representing a 17 percent monthly rise.

The inventory of loans in foreclosure declined by more than 30 percent year-over-year, edging out 2013 for the highest rate of decline on record. Severely delinquent foreclosures, defined as those that haven’t made a payment in over two years, dropped by 38 percent from 2015. Less delinquent foreclosure inventory dropped by 21 percent.

December also saw only 59,700 foreclosure starts, a 24 percent decline from the same time one year ago.

Continue reading.

by LLT | Feb 6, 2017 | LLT, News

Gary Gohn, director of the National Economic Council

The Trump administration was set to release an executive order Friday calling for a review of the Dodd-Frank Act, the clearest sign yet of the White House’s intent to roll back the onslaught of regulations since the 2010 law was passed.

But the immediate questions about the order focused on what authority the White House has to enact real change, since congressional Democrats are resistant to rolling back the law and those running the regulatory agencies are still Obama administration appointees.

News of the order, which appeared to be timed with President Trump’s scheduled meeting with business leaders, first came out in a media interview with National Economic Council Director Gary Cohn. He spoke of possible reforms including changes to the Financial Stability Oversight Council, the “living wills” process, a facility for resolving failed companies and even reforms for the housing finance system.

Continue reading.

by LLT | Feb 3, 2017 | LLT, News

Mortgage rates held steady this week, pausing ahead of the Federal Reserve meeting and Friday’s employment report.

Mortgage rates held steady this week, pausing ahead of the Federal Reserve meeting and Friday’s employment report.

As expected, the central bank did not raise its benchmark rate when it met earlier this week. The news, however, came too late to influence Freddie Mac’s survey. The government-backed mortgage-backer aggregates current rates weekly from 125 lenders from across the country to come up with a national average mortgage rate.

According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average was unchanged this week at 4.19 percent with an average 0.5 point. (Points are fees paid to a lender equal to 1 percent of the loan amount.) It was 3.72 percent a year ago.

The 15-year fixed-rate average inched up to 3.41 percent with an average 0.5 point. It was 3.4 percent a week ago and 3.01 percent a year ago. The five-year adjustable rate average ticked up slightly to 3.23 percent with an average 0.4 point. It was 3.2 percent a week ago and 2.85 percent a year ago.

Continue reading.

The surge in home values is good news for homeowners looking to tap the equity in their homes to pay down debt or make big purchases, but consumer advocates worry that it may be setting the stage for a spike in loan defaults.

The surge in home values is good news for homeowners looking to tap the equity in their homes to pay down debt or make big purchases, but consumer advocates worry that it may be setting the stage for a spike in loan defaults.

Recent Comments